World Energy Outlook 2025: What the IEA Outlook — and AIB stats — really mean for Europe’s GO market

The Guarantees of Origin (GO) framework underpins renewable electricity claims across the EEA, Switzerland, and Serbia. IEA’s World Energy Outlook 2025 points to accelerating electrification and surging renewables—trends that will expand GO volumes and complicate market dynamics. But AIB registries show the market is already shifting: issuance is rising fast, cancellations are rising faster, and the supply–demand balance looks different than many summaries suggest.

Why this matters for Europe

Electrification of transport, heat, and industry will continue to lift electricity demand. Alongside evolving disclosure and interoperability requirements, this puts GOs at the center of Scope 2 strategies and supplier disclosure.

GO lifecycle (practical view)

GOs are typically issued on a monthly basis after production reporting and verification, cancelled when used to substantiate a supplier disclosure or a corporate claim, and subject to a ~12-month validity window in many European domains.

Issuance trends and outlook

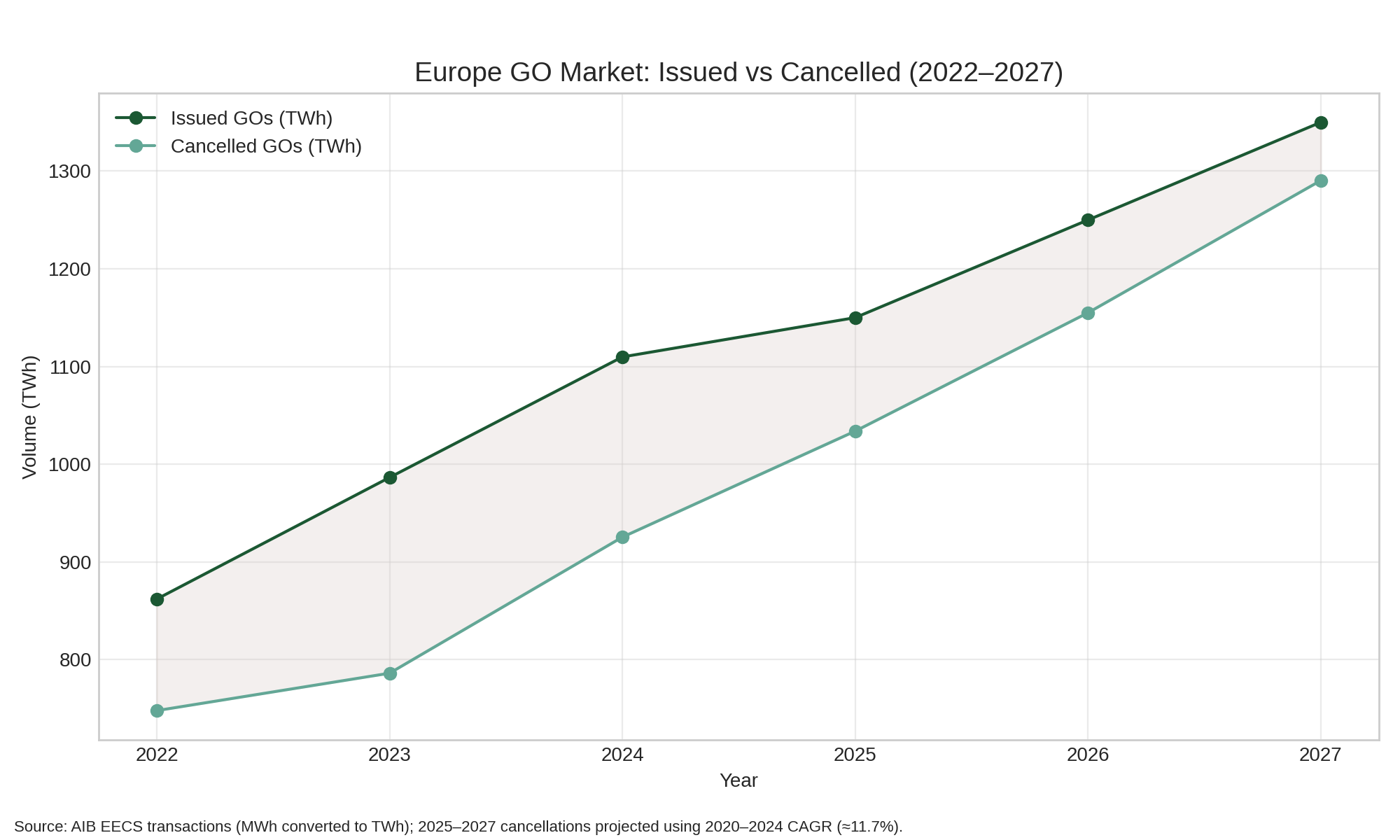

AIB EECS data show rising issuance: ~862 TWh (2022), ~986 TWh (2023), and ~1,110 TWh (2024). Cancellations climbed even faster—from ~594 TWh (2020) to ~925 TWh (2024)—a CAGR of ~11.7% over 2020–2024.

Supply–demand balance under a simple forward scenario

Using issuance path for 2025–2027 (1,150; 1,250; 1,350 TWh) and projecting cancellations by applying the observed CAGR (~11.72%) to the 2024 cancellations level (925.3 TWh).

What this means for market participants

A larger, more liquid GO market is coming—but it will not behave like a simple commodity. While volumes are increasing, the underlying dynamics are shaped by regulatory frameworks, disclosure requirements, and evolving buyer preferences. This means that price formation will remain sensitive to policy signals and demand-side integrity criteria rather than purely supply-driven fundamentals.

Standard annual GOs: Price pressure is still possible in the short term, especially if issuance outpaces cancellations in certain domains. However, tightening surpluses and the growing role of corporate procurement argue against assuming a one-way decline. Market participants should expect periods of volatility rather than a linear trend, with seasonal issuance patterns and compliance deadlines influencing liquidity.

High-integrity products: Certificates linked to additionality, location-specific generation, or bundled with PPAs will continue to command premiums. These products are increasingly relevant for companies seeking to meet science-based targets or RFNBO compliance. Buyers should anticipate that these attributes will become differentiators in procurement strategies, and sellers should prepare to demonstrate traceability and verification rigor.

Temporal granularity: Hourly or sub-hourly matching remains a niche today, driven by RFNBO rules and select large-buyer pilots. While not a mass-market requirement, monitoring the developments in these initiatives remains important.

Portfolio strategy implications: As the market matures, timing and registry interoperability will matter more. Cross-border transfers, lifecycle rules, and expiry windows introduce complexity that can affect cost and risk. Participants should invest in systems that enable real-time visibility of positions and automate compliance checks to avoid stranded certificates.

Risk and opportunity: The GO market is evolving from a compliance instrument into a strategic procurement tool. Those who treat GOs as a commodity risk mispricing and missed opportunities. Instead, think in terms of portfolio optimization—balancing cost, integrity, and flexibility. Engaging early with suppliers, securing high-quality attributes, and aligning procurement with disclosure frameworks will be key to maintaining competitive advantage.